new short term capital gains tax proposal

Ad The money app for families. Joe Biden proposes that for individuals with taxable income greater than 1M in a year their capital gains would be taxed as ordinary income under standard income bracketsup to 37 under current tax code and up to.

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

The new tax would affect an estimated 58000 taxpayers in the first year.

. The proposed higher tax on capital gains would be consistent with President Bidens promise to limit tax increases to. Californias combined state and federal capital gains tax would be the highest at 567 followed by New York at 543 and New Jersey at 542 the study shows. Currently the top ordinary rate for individuals is 37 but the AFP also.

The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. The IRS expanded the income range for each tax bracket so youll be able to make a.

As part of his presidential platform president Biden has proposed changing the special treatment on income from the sale of capital assets. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Download the app today.

The top long-term capital gains rate has been 20 since 2013 according to. 2 Short-term capital gains are taxed just like your ordinary income. The top short-term capital gains tax rate is 37.

Thats the Greenlight effect. Note however that proposal also calls for an increase in ordinary income rates to a top rate of 396. Under this proposed tax combined federal and state taxes on capital gains would average 48 percent itself a 66 percent increase over current law exceed 50 percent in thirteen states and the District of Columbia and reach 582 percent in New York City12 The combined average federal and state capital gains would surpass Denmark Chile and France to become.

The institution says raising capital gains tax rates to the proposed level would be the highest since the 1920s potentially shaving off 01 percent from economic growth and reducing federal. The short-term capital gains tax is typically applied to the sale of securities including stocks and mutual funds. 3 Capital assets include stocks bonds precious metals jewelry and real estate.

Best short-term investments. 2021 and subsequent taxation years in respect of certificates filed post Royal Assent. Proposed capital gains tax Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is.

Thatâ s up to 37 in 2021 depending on your tax bracket. The tax rate on most taxpayers who report long-term capital gains is 15 or lower. Short-term capital gains tax is a tax on gains resulting from the sale of assets youve held for one year or less.

History Of The Top Long-Term Capital Gains Tax Rate. There is also an amendment that will increase the top marginal tax rate from 37 to 396. Capital gain tax changes.

The plan proposed by House Democrats will also add a 3 percent tax for those with modified adjusted gross income above 5 million from 2022 and on top of that increasing the capital gains tax rate to 15. Sole proprietor income retirement accounts homes farms and forestry are exempt. Capital gains tax changes 2022.

Remember this isnt for the tax return you file in 2022 but rather any gains you incur from January 1 2022 to December 31 2022. Tax on capital gains would be raised to 288 per cent by House Democrats. But its also possible to be assessed short-term capital gains tax on the sale of other assets such as real estate vehicles or collectibles.

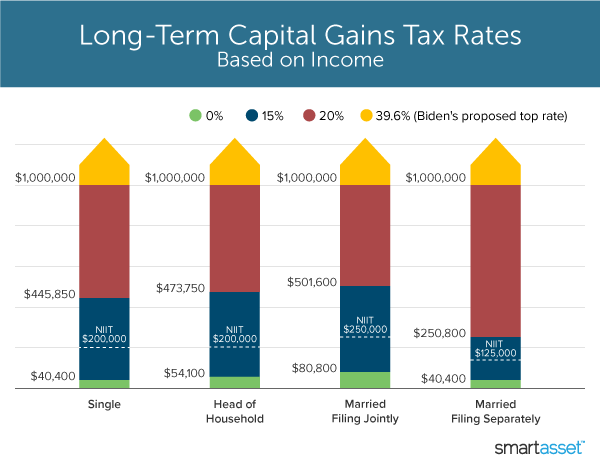

Long-term investors unlock the 0 15 and 20 capital gains rates. According to a House Ways and Means Committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022. In the American Families Plan AFP the Biden Administration is proposing an increased tax rate on capital gains and qualified dividends to equal the top ordinary income tax rate of 396 for households earning over 1 million or 500000 if married filing separately.

Capital Gains Tax Rate 2022. 7 rows Federal short-term capital gainsincome tax rate Single Married filing jointly Married. It would apply to those with more than 1 million in annual income according to Bloomberg.

For 2021 the 15 bracket for capital gains begins at 40401 of taxable income for single filers. Given the retroactive nature of this proposal it may be difficult to avoid this higher tax rate where income exceeds 400000.

Tds Rate Applicable On Mf Redemptions By Nris For Ay 2021 22 Mutuals Funds Capital Gain Fund

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

How High Are Capital Gains Taxes In Your State Tax Foundation

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Accounting Taxation Income Tax Audit Requirements Interest Rates Penalty Appel Fees Deductions Capital Gain Rates Income Tax Income Tax Return Income

Selling Stock How Capital Gains Are Taxed The Motley Fool

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

2022 And 2021 Capital Gains Tax Rates Smartasset

What S In Biden S Capital Gains Tax Plan Smartasset

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Year End Planning For Stock Options Restricted Stock And Espps 6 Items For Your Checklist

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Loss Set Off Rules On Sale Of Stocks Equity Mutual Fund Schemes Mutuals Funds Budgeting Fund

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Capital Gains Tax

2022 And 2021 Capital Gains Tax Rates Smartasset

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Simpler Structure Capital Gains Taxes May Be Up For Review The Financial Express