greenville county property tax estimator

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. Citys property tax rate has dropped by 55 percent to 49 per cent.

Want To Rent Your House Well You Re Going To Have To Pay Up Greenville Journal

Census Bureau American Community Survey 2006-2010.

. Only search using 1 of the boxes below. Any errors omissions or inaccuracies in the information provided regardless of how caused or. Free Comprehensive Details on Homes Property Near You.

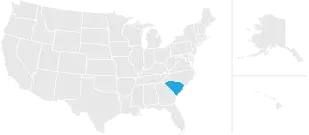

County functions supported by GIS include real estate tax assessment law enforcement. 2021 Millage Chart PDF How To Estimate Real Estate Taxes. In states like South Carolina where vehicle value is a part of property taxes youll receive a separate bill.

Contact your county tax. If paying by mail please make your check payable to Greenville County Tax Collector and mail to. Yearly median tax in Greenville County.

Our mission is to provide accurate and timely geographic information system access technical assistance and related services to meet the needs of County operations. Lexington County shall assume no liability for. Tax Collector Suite 700.

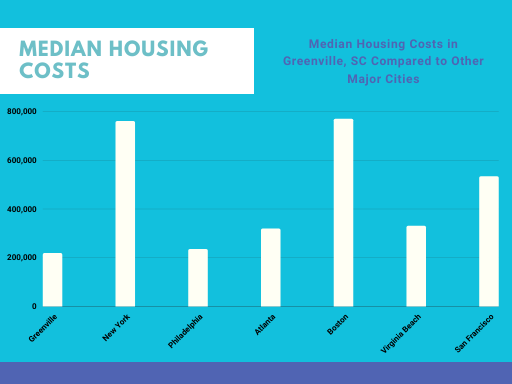

Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher than the state average. The median property tax on a 14810000 house is 155505 in the United States. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Greenville County.

Reassessment Program PDF Assessors Sales Report. The largest tax in. Estimate Your Home values for Free Connect with Top Local Real Estate Agents.

See Results in Minutes. Estimated Range of Property Tax Fees. Greenville County South Carolina.

066 of home value. Ad Enter Any Address Receive a Comprehensive Property Report. Greenville County collects relatively low property taxes and is ranked in the bottom half of all.

In 1984 when all this began the rate was set at seven cents. View Agendas Minutes Ordinances Watch Meetings. 903 408-4001 Chamber of Commerce Office 1114 Main St.

Greenville County collects on average 066 of a propertys assessed fair market value as property tax. Questions concerning the Countys tax levies may be addressed to the Tax Collectors Office at. Ad Just Enter your Zip for Online Property Tax Info Near You.

South Carolina is ranked 1523rd of the 3143 counties. According to Carvana the annual property taxes on vehicles vary from state to state and can vary from city to city as well. The next set of costs a vehicle owner will see in South Carolina is the portion of property taxes due according to the value of the vehicle.

Welcome to the Greenville County Geographic Information Systems GIS homepage. Please enter the following information to view an estimated property tax. Board of Assessment and Appeals.

The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. According to county budget documents Greenville County expects to collect 9389 million in property taxes in fiscal year 2018. The median property tax on a 13750000 house is 144375 in the United States.

Learn all about Greenville County real estate tax. 2500 Stonewall Street Suite 101 Greenville TX 75403. Property tax is calculated by multiplying the propertys assessed value by the total milage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

The rates are expressed as millages ie the actual rates multiplied by 1000. Calculate your actual tax bill incorporating any exemptions that apply to your property. Actual property tax assessments depend on a number of variables.

Lexington County explicitly disclaims any representations and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose. A 100 assessed value will be assessed at 45 cents. Council has approved a property tax rate that is significantly higher than a revenue neutral rate of 47 for municipalities.

What looks like a large increase in value may only give a negligible hike in your property tax payment. Tax rates vary according to the authorities ie school fire sewer that levy tax within individual tax districts of Greenville County. The calculator should not be used to determine your actual tax bill.

Your county vehicle property tax due may be higher or lower depending on other factors. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Expert Results for Free.

This calculator is designed to estimate the county vehicle property tax for your vehicle. Property Tax Appraisals The Greenville County Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable properties in the same neighbourhood. Ad Just Enter your Zip for Online Property Tax Info Near You.

Find All The Record Information You Need Here. Expert Results for Free. Agricultural Use Application PDF Assessor GIS Property Search.

Contact the Real Property Services Division at Greenville County Square Suite 1000 or call 8644677300 for the forms to appeal the assessed valuation of the property. This estimator is based on median property tax values in all of South Carolinas counties which can vary widely. At this stage you may need help from one of the best property tax attorneys in Greenville SC.

The countys average effective rate is 069. Unsure Of The Value Of Your Property. Whether you are already a resident or just considering moving to Greenville County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

--Select one-- Camper - 1050 Vehicle Business - 1050 Vehicle Individual - 600 Watercraft - 1050. Greenwood County Tax Estimator South Carolina SC. The Greenville County assessors office can help you with many of your property tax related issues including.

For a more specific estimate find the calculator for your county.

South Carolina Property Tax Calculator Smartasset

How Greenville County Assesses Taxes The Home Team

South Carolina Property Tax Calculator Smartasset

Tax Rates Hunt Tax Official Site

Fees Annexation Greater Greenville Sanitation

Why Land Values Are Rising In Greenville County South Carolina

Greenville County Council Candidates Answer Our Questions

Ultimate Guide To Understanding South Carolina Property Taxes

Four Reasons Why You Should Locate Your Business In Greenville South Carolina Greenville Area Development Corporation

Moving To Greenville Sc 10 Things You Ll Love About Your Move To Greenville Sc

Greenville Cost Of Living Greenville Sc Living Expenses Guide